Adding a payment gateway to your small business website can help increase sales by making it easier for customers to pay for products and services. There are a number of different payment gateways available, so it’s important to choose one that meets the needs of your business and customers. This article provides an overview of some of the most popular payment gateways, as well as the pros and cons of each.

Thai E-payment

Chinese E-payment

Mobile Banking (Deep link)

Credit / Debit Card Full

Credit Installment

KTC Installment3-10 Mounts

Bank Installment3-10 Mounts

transaction Fee

Accepting payments are charged per successful transaction.

| Digital WALLET | Wechat pay | 2.6% | |

|---|---|---|---|

| Alipay | 2.8% | ||

| True Money | 2.8% | ||

| Rabbit Line Pay | 3.3% | ||

| Shoppee Pay | 2.8% | ||

| DEBIT/ CREDIT | NonInstallment | 3.2% | |

| Installment | 2.6% | ||

| 2.6% | |||

| 2.9% | |||

| MOBILE BANKING | Promtpay | 0.8% | |

| K+ | 2.7% | ||

| FIX RATE MOBILE BANKING | K+ | 17 BAHT | |

| SCB EASY | 15 BAHT | ||

| Bualuang | 15 BAHT | ||

| KMA | 15 BAHT |

Our Customers

Why using E-Wallet & Pay & Payment Gateway ?

Secure

• Each E-Wallet has security systems.• There is an OTP authentication system.• There is a system to confirm the identity with biological information such as face recognition or finger scan.

Convenience

• Customers can pay anywhere & anytime.• The payment process is much easier than paying via card.

Fast

• The system is Real- Time.• Save time in calculating and checking bank notes.• Get money faster

Sell Increase

There are marketing and promotions from e-wallet for both merchants and customers.

Security

▪ PCI DSS▪ Fraud protection▪ E-Payment Service Provider License

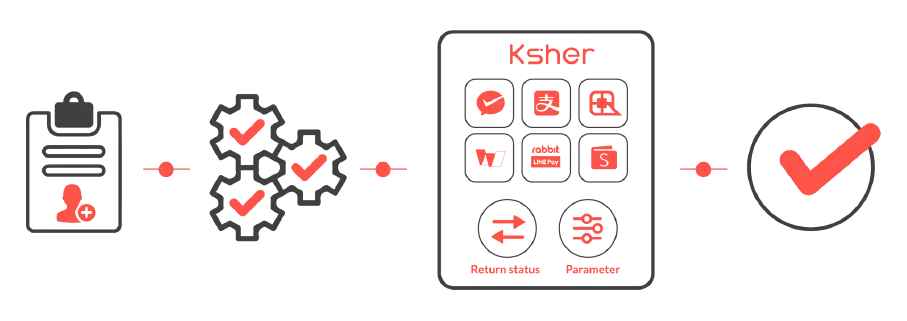

IT Integration

▪ All-in-one integration▪ Developer-friendly▪ Fast & Save time

Financial

▪ T+1 Settlement▪ No Settlement transfer fee ▪ Multi-type refund method

Report

▪ Easy tracking▪ Real time▪ No time limit for data checking and download

สนใจ สมัครใช้บริการ Ksher กับเรา

กรอกข้อมูลที่นี่